Our Blog

Choosing the Right Office Space: Coworking, Managed, or Conventional

Office space is no longer just a physical requirement—it is a strategic business decision that impacts cost, flexibility, company culture, and long-term scalability. From startups to large enterprises, every organization faces the same question: Should we choose coworking, opt for a managed office, or commit to a conventional leased or owned office? Each model has unique strengths, trade-offs, and hidden costs. Here’s a detailed comparison.

Coworking Offices

When to Consider

- Startups or firms entering new markets

- Businesses with uncertain headcount growth

- Companies needing immediate occupancy without capital expenditure

Advantages

- Speed of occupation with ready-to-move spaces

- Flexibility with short lock-ins and easy expansion or downsizing

- Low upfront investment as furniture, IT, and services are included

- Community environment with networking opportunities

Challenges

- Higher per-seat costs

- Limited privacy and branding opportunities

- Shared facilities may affect productivity

- Cultural alignment issues for larger enterprises

Hidden Costs: Meeting room charges, parking, storage, and premium services.

Market Trend: Large corporates now contribute 30–40% of coworking demand, using it for satellite offices, new city entries, or hybrid models.

Managed Offices

When to Consider

- Mid-to-large enterprises with stable growth for 2–5 years

- Companies needing branded private offices without upfront investment

- Organizations preferring predictable monthly costs

Advantages

- Customization in branding, layouts, and IT infrastructure

- Predictable all-inclusive costs covering rent, utilities, security, and housekeeping

- Scalability within the same operator’s ecosystem

- Enterprise-grade feel without capital expenditure

Challenges

- Higher recurring costs compared to conventional leasing

- Vendor lock-in risks

- Less economical for very long-term commitments

Hidden Costs: Charges for customization outside standard packages, lock-in and exit penalties.

Market Trend: Fastest-growing segment in India, with operators like WeWork, Awfis, Smartworks, and IndiQube serving enterprise clients of 200–2,000 seats.

Conventional Leased or Owned Offices

When to Consider

- Large, stable enterprises with long-term visibility

- Businesses prioritizing branding and complete control

- Companies viewing real estate as a long-term investment

Advantages

- Lower recurring rent per seat compared to other models

- Full control over design, branding, and vendors

- Stability through long-term leases

- Potential for asset appreciation in case of ownership

Challenges

- High upfront capital expenditure for fit-outs, deposits, and compliance

- Longer search and negotiation cycles

- Limited flexibility to downsize or exit

- Risk of underutilization if projections fall short

Hidden Costs: Maintenance charges (CAM), property taxes, compliance, and annual rental escalations of 5–8%.

Market Trend: Still the backbone for IT majors and Fortune 500s, though often complemented with coworking or managed spaces for hybrid strategies.

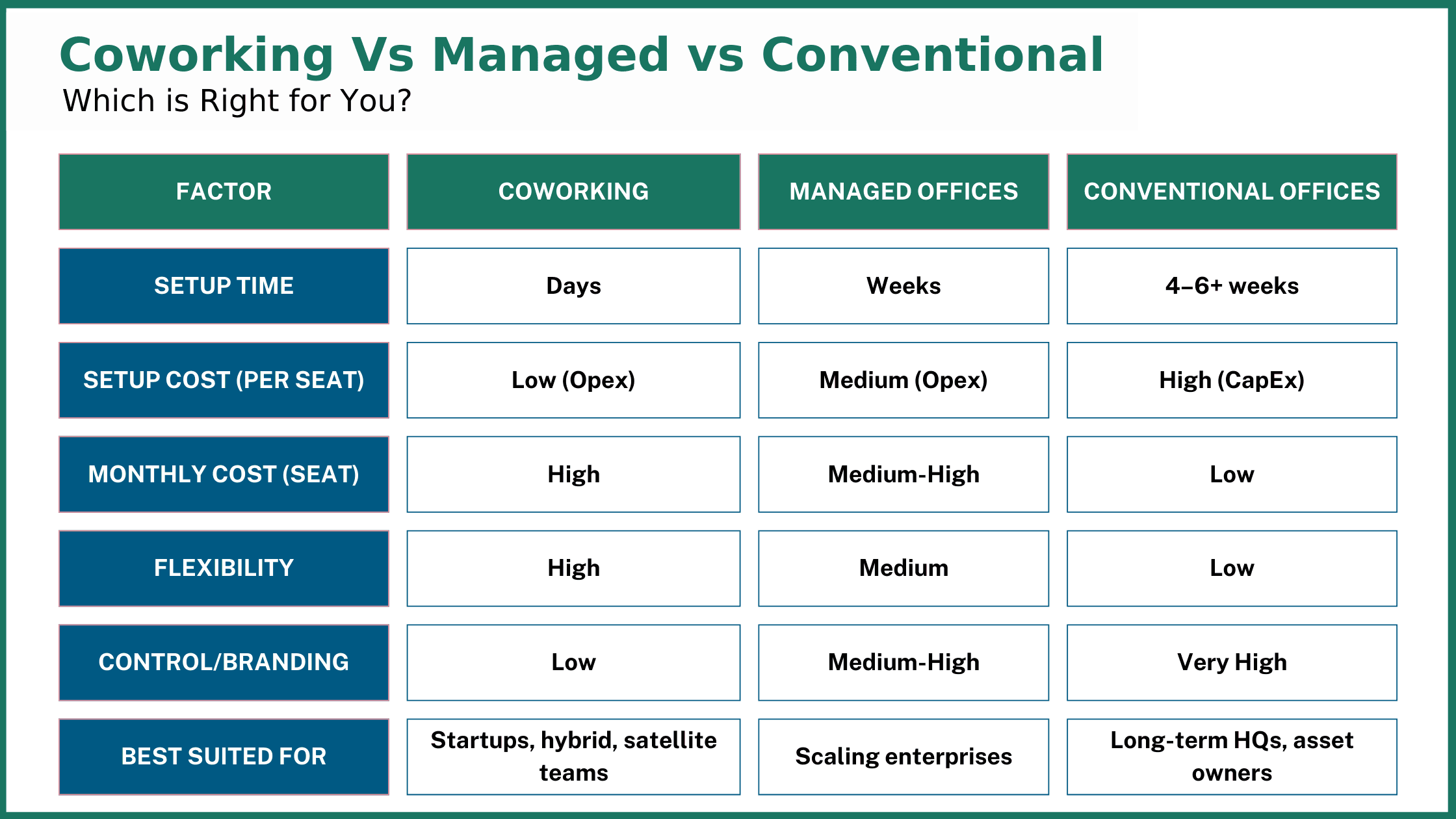

The Decision Matrix

Key Insights

- Coworking offers unmatched speed and flexibility but comes at a premium.

- Managed offices strike a balance between scalability and control.

- Conventional offices provide cost efficiency and stability but lack agility.

Many enterprises today adopt a blended approach: a conventional HQ with managed or coworking setups for expansions, projects, or hybrid teams.

Aakash Jain

Director